Purchasing a Gold Individual Retirement Account: A Comprehensive Overview

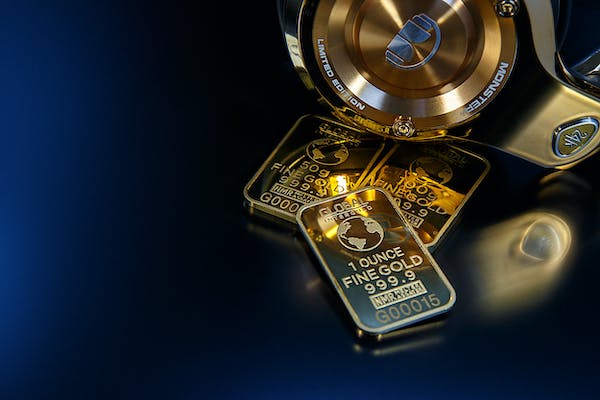

Gold has actually been a popular investment for centuries, and completely factor. It is a concrete property that has held its worth with time, also throughout periods of economic chaos. In the last few years, gold has ended up being significantly prominent among financiers as a method to hedge against inflation and shield their wealth.

Purchasing a Gold Individual Retirement Account: Advantages And Disadvantages Discussed

Gold IRAs have come to be progressively prominent recently, as financiers seek methods to diversify their portfolios and shield their wealth from rising cost of living. However exactly what is a gold individual retirement account, and what are the advantages and disadvantages of buy gold IRA one?

What is a Gold IRA?

A gold individual retirement account is a sort of individual retirement account (IRA) that permits financiers to hold physical gold in their retirement profile. Gold IRAs are subject to the same regulations and regulations as standard Individual retirement accounts, yet they use a variety of distinct advantages, including:

Diversity: Gold can aid to expand your retired life portfolio and decrease your general danger. Because gold is not correlated with the stock exchange, it can supply a bush versus securities market slumps.

Rising cost of living defense: Gold has actually historically held its value well during durations of rising cost of living. This makes it an excellent investment for shielding your retired life financial savings from the erosive impacts of rising cost of living.

Tangibility: Gold is a concrete property that you can actually keep in your hands. This can be appealing to investors who are worried regarding the safety of their retired life savings.

Pros of Buying a Gold individual retirement account

Right here are a few of the crucial pros of investing in a gold IRA:

Diversification: As discussed above, gold can help to expand your retired life profile and reduce your overall danger. This is since gold is not correlated with the stock market, suggesting that it can execute well also when the stock exchange is down.

Inflation security: Gold has a long background of holding its worth during periods of inflation. This is since gold is seen as a safe haven property, and investors frequently group to gold during times of financial uncertainty.

Tangibility: Gold is a physical property that you can really keep in your hands. This can be attracting capitalists that are concerned concerning the safety and security of their retirement cost savings.

Tax benefits: Gold IRAs supply the very same tax benefits as traditional IRAs. This means that you can grow your retirement savings tax-deferred or tax-free, depending upon the sort of gold IRA you choose.

Cons of Investing in a Gold individual retirement account

Below are several of the vital cons of buying a gold IRA:

Fees and costs: Gold IRAs generally have greater charges and costs than standard Individual retirement accounts. This is because gold IRAs call for the purchase and storage of physical gold.

Volatility: The cost of gold can be unstable, and it can fluctuate extremely in the short-term. This indicates that there is a danger of losing cash on your gold financial investment.

Liquidity: Gold can be tough to market quickly, especially in large quantities. This implies that it may not be the most effective investment for capitalists that need to access their money promptly.

Storage: Gold must be saved in an IRS-approved vault. This can be inconvenient and costly for some investors.

Just how to Open Up a Gold Individual Retirement Account

To open up a gold IRA, you will certainly need to call a gold IRA custodian. A gold individual retirement account custodian is a financial institution that is authorized to hold physical gold on behalf of IRA account holders. When you have selected a gold IRA custodian, you will need to open up a new IRA account and fund it with pre-tax or after-tax bucks.

When your gold IRA is moneyed, you can start acquiring gold coins or bars. The gold that you buy must fulfill particular pureness demands established by the IRS. You can acquire gold from a variety of resources, including gold suppliers, coin stores, and online sellers.

Storing Your Gold

As soon as you have bought gold for your gold individual retirement account, you will need to save it in an IRS-approved depository. IRS-approved depositories are safe facilities that are created to protect your gold from burglary and loss. Your gold IRA custodian will certainly aid you to pick an IRS-approved vault and arrange for your gold to be kept there.

Fees and Costs

Gold IRAs usually have greater fees and expenses than conventional Individual retirement accounts. This is because gold Individual retirement accounts call for the acquisition and storage space of physical gold. Usual fees connected with gold IRAs include:

Account setup costs: Many gold individual retirement account custodians bill an account arrangement fee to open up a brand-new gold IRA account.

Annual maintenance costs: Gold individual retirement account custodians likewise usually bill an annual upkeep charge to hold your gold IRA account.

Storage fees: IRS-approved vaults bill a fee to store your gold.

Deal costs: Gold individual retirement account custodians generally charge a deal cost each time you purchase or sell gold.

Dangers and Factors to consider

Prior to purchasing a gold IRA, it is very important to understand the dangers and considerations entailed. Gold is an unstable possession, and its rate can rise and fall extremely. This indicates that you could lose money on your gold financial investment.

Gold IRAs are also based on the same rules and regulations as typical IRAs. This means that you will certainly be required to take needed minimum circulations (RMDs) from your gold individual retirement account when you get to retirement age. If you stop working to take RMDs, you might undergo a fine tax obligation.

Is a Gold IRA Right for You?

Whether a gold individual retirement account is right for you depends on your private financial investment objectives and risk resistance. If you are trying to find a way to expand your retired life profile and protect your wealth from inflation, a gold IRA may be an excellent option for you.

Nevertheless, it is very important to consider the dangers and benefits of gold IRAs carefully prior to making an investment choice. You should additionally consider your financial investment goals and run the risk of resistance. If you are not comfortable with the volatility of gold or the costs associated with gold IRAs, then a gold individual retirement account might not be the right financial investment for you.

How to Choose a Gold IRA Custodian

When choosing a gold individual retirement account custodian, there are a variety of aspects to consider, including:

Costs and expenses: Contrast the charges and expenditures billed by different gold IRA custodians.

Credibility: Choose a gold individual retirement account custodian with an excellent online reputation. You can read on the internet evaluations and consult the Bbb to get more information about various gold individual retirement account custodians.

Customer care: Make certain to pick a gold individual retirement account custodian that offers excellent customer care. You ought to have the ability to easily get to a customer service rep if you have any inquiries or problems.

Verdict

Gold IRAs can be a great way to diversify your retired life portfolio and safeguard your wealth from inflation. Nevertheless, it is essential to recognize the risks and considerations included prior to making a financial investment decision. You must likewise consider your investment goals and take the chance of tolerance to figure out if a gold IRA is right for you.

If you are taking into consideration investing in a gold IRA, make sure to do your research and compare different gold IRA custodians before choosing. You must additionally talk to a monetary consultant to get individualized advice.